For Traders

“Join our Trader’s Technical Education Program for hands-on learning and live market practice in Equity, Derivatives, Commodity, and Currency markets. Gain insights into diverse asset classes, assessing return versus risk and understanding the ideal holding time for specific returns. The key to success lies in following risk management principles and incorporating stop-loss strategies for consistent returns and capital protection. As the saying goes,

“THE STOCK MARKET REMAINS AN INTERESTING SOURCE FOR ALL KINDS OF INVESTORS TO CREATE WEALTH.”

“In our Training Program, 30% emphasis is given to practical implementation through live trading sessions on charts, enhancing candidates’ confidence in making buy or sell decisions. We focus on screen reading and price reading skills, crucial for market understanding. While theory is accessible through books, websites, and YouTube, we acknowledge the distinct difference between theory and the practical skills required for trading and making money. Just as reading about swimming book 10 times doesn’t make you a swimmer, practical experience is key.”

“At the culmination of our course, candidates are empowered to trade like professional traders, relying on the chart practice undertaken during the class. The philosophy is clear:

“When the money is yours, why let others decide what to trade in your account? Be a self-trader.”

To achieve this, one needs to learn technical analysis, engage in continuous chart practice, and leverage our knowledge, rules, and experience to enhance confidence in making money from the stock market. Remember,

“ALL SUCCESSFUL TRADERS BEGAN AS A BEGINNER; TRUST THE PROCESS AND STAY DISCIPLINED.”

our curriculum

What we bring to you

Indian Stock market

Share Market Cycle : Bull, Bear and Sideways

Two Heads Better than One

Concept of Technical Analysis

Fundamentals of Technical Analysis

Understanding its Pros & Cons

Charts And Its Patterns

Line Chart

Bar Chart and Candlestick Chart

Simple, Complex and Western Chart

Implementation Of Indicators In Charts

Support and Resistances

Trend Indicators

Correct order of Moving Averages

Concept of Fundamental Analysis

Financial Statement Analysis

Decoding an Annual Report

Theory On Technical Analysis

Dow Theory, Tenets, Criticisms

Breakout Theory

Demand and Supply Zone

Boring and Explosive Candles

Types of Supply and Demand patterns

Identifying strong supply & demand zones

Implementation Of Indicators In Charts

Momentum Indicator

Divergence

Volume Indicators

How To Select Trade For Buy & Sell ?

Steps Before Taking Trade

Analysis of Microeconomics and Macroeconomics data

Must Check Indian market with global market

Check Fii and Dii Money flow data

Steps While Taking Trade

Trading on rumours

Trading on financial news

OHLC Theory

52 week High vs 52 week Low Theory

Screen Reading and Price Reading

Price and Volume Analysis

Correlation Analysis

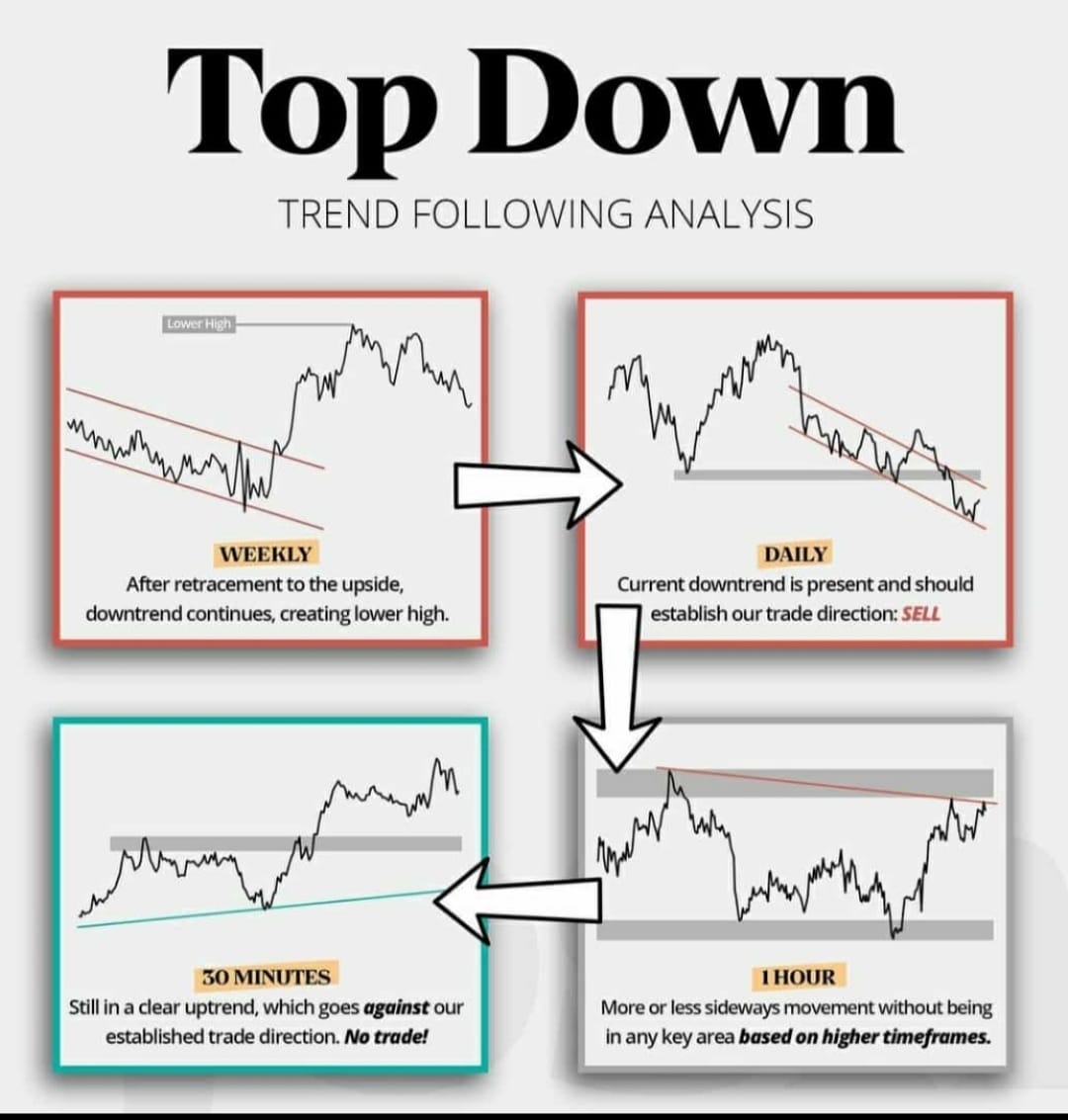

Trading Strategies – Trend Following, Swing & Contrarian

Which Segment is best to trade

Position Sizing & Money Management Techniques

Setup for Trade : Entry, Target, Stop loss

Steps After Taking trade

The Psychology of Successful Traders

Setup for exit : Target, Stop loss and Exit Rules

Capital Protection and Risk Management

Margins, Clearing and Settlement

Consistency is the key to success

Use and Importance Of Derivatives

Equity, Forwards and Futures Markets

Option terminology

Understanding Call and Put Concept

Option Greeks -Delta Vega Theta Rho and Gamma

Options Strategies – Bull, Bear and hedging Strategies

Options Strategies -Volatile and Non-Volatile Strategies

Open Interest and Rollover

Margins, Clearing and Settlement

Total 24 Hours of Sessions in 5 Days

7.20 Hours and twinty minutes for Practice on Charts during live market

Will Provide supplementary study material

Module Test